Jun 27, 2023KEY POINTS Credit cards offer great perks like credit building, fraud protection, and rewards on your spending. If you overspend with your card, you risk a higher credit utilization ratio —

What are the benefits of using Pinterest for businesses and bloggers? – Quora

Nov 14, 2022Stick to your financial goals. One of the most impactful ways to avoid credit card overspending is to create a budget or financial plan and stick to it. It’s important to understand how much you have coming in each month and track your spending accordingly. You may find you’re overspending on certain items and neglecting important areas

Source Image: informalnewz.com

Download Image

Overspending on a credit card can put a strain on your budget and potentially damage your credit score. You can avoid overspending by tracking your spending, only making purchases that you can pay off and resisting the urge to overspend for rewards.

Source Image: juststartinvesting.com

Download Image

Knowing the Credit Card Pros and Cons | Liberty Debt Relief’s Advice

Nov 27, 2023Credit cards offer benefits that include worldwide purchasing power, rewards on your spending and protection against fraud, among other perks. But credit cards can lead to overspending, high

Source Image: ritecheck.com

Download Image

What Are The Advantages To Overspending With Credit

Nov 27, 2023Credit cards offer benefits that include worldwide purchasing power, rewards on your spending and protection against fraud, among other perks. But credit cards can lead to overspending, high

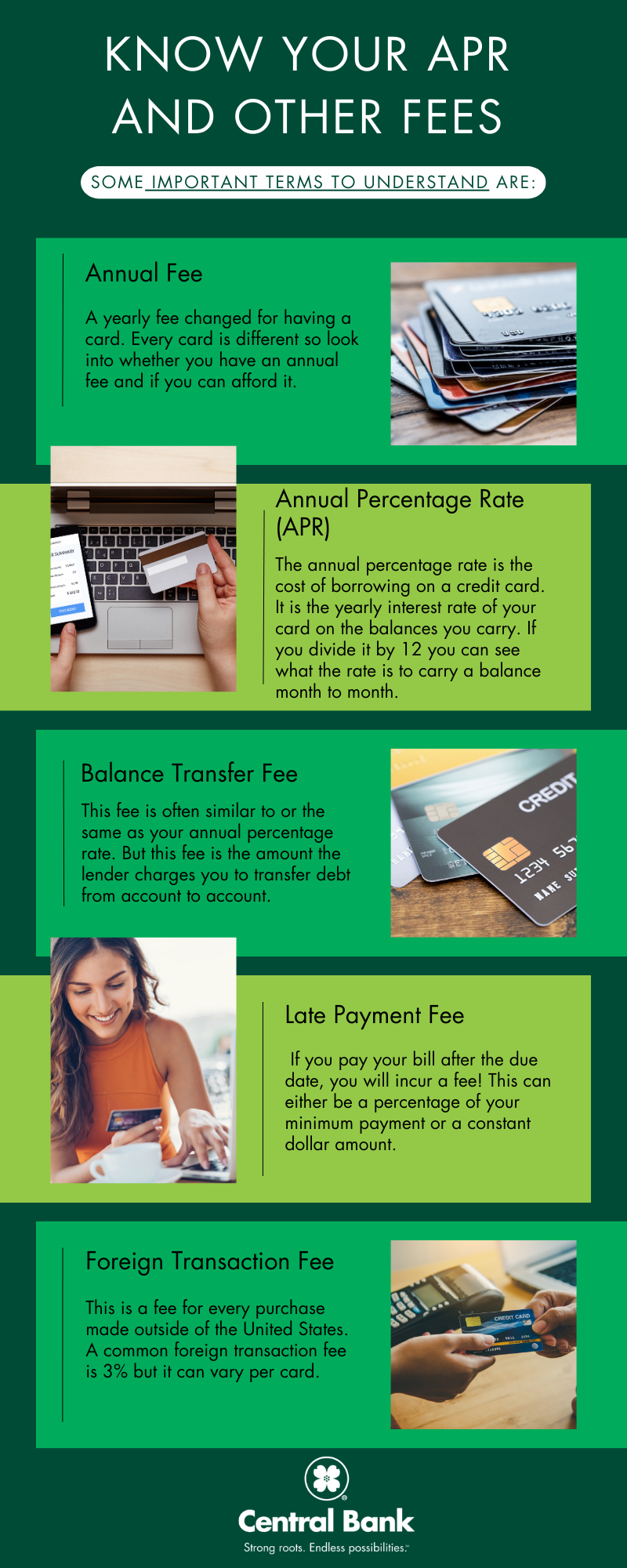

Jun 29, 2023June 29, 2023, at 9:00 a.m. The Pros and Cons of Credit Cards. iStockphoto. Credit cards offer rewards and other perks but can come with sneaky fees. Credit cards sometimes get a bad rap. Critics

Netspend Card | RiteCheck

May 31, 2023Another often-cited study is one conducted by Dun & Bradstreet, in which the company found that people spend 12%-18% more when using credit cards instead of cash. The Federal Reserve Bank of

Using a Credit Card for Dropshipping: What You Should Know

Source Image: dodropshipping.com

Download Image

Credit Card Rules to Live By | Central Bank

May 31, 2023Another often-cited study is one conducted by Dun & Bradstreet, in which the company found that people spend 12%-18% more when using credit cards instead of cash. The Federal Reserve Bank of

Source Image: centralbank.net

Download Image

What are the benefits of using Pinterest for businesses and bloggers? – Quora

Jun 27, 2023KEY POINTS Credit cards offer great perks like credit building, fraud protection, and rewards on your spending. If you overspend with your card, you risk a higher credit utilization ratio —

Source Image: quora.com

Download Image

Knowing the Credit Card Pros and Cons | Liberty Debt Relief’s Advice

Overspending on a credit card can put a strain on your budget and potentially damage your credit score. You can avoid overspending by tracking your spending, only making purchases that you can pay off and resisting the urge to overspend for rewards.

Source Image: libertydebtrelief.com

Download Image

The Cashless Effect: Why Credit Cards Make It So Difficult to Budget

Talk about wasted money. Furthermore, overspending on credit cards could drive down your credit score. One big factor that plays a role in determining your credit score is your credit

Source Image: scitechdaily.com

Download Image

How To Use Your Credit Cards Efficiently? – CreditMantri

Nov 27, 2023Credit cards offer benefits that include worldwide purchasing power, rewards on your spending and protection against fraud, among other perks. But credit cards can lead to overspending, high

Source Image: creditmantri.com

Download Image

Credit Card Spending – Why We Overspend and How to Control It? –

Jun 29, 2023June 29, 2023, at 9:00 a.m. The Pros and Cons of Credit Cards. iStockphoto. Credit cards offer rewards and other perks but can come with sneaky fees. Credit cards sometimes get a bad rap. Critics

Source Image: indusind.com

Download Image

Credit Card Rules to Live By | Central Bank

Credit Card Spending – Why We Overspend and How to Control It? –

Nov 14, 2022Stick to your financial goals. One of the most impactful ways to avoid credit card overspending is to create a budget or financial plan and stick to it. It’s important to understand how much you have coming in each month and track your spending accordingly. You may find you’re overspending on certain items and neglecting important areas

Knowing the Credit Card Pros and Cons | Liberty Debt Relief’s Advice How To Use Your Credit Cards Efficiently? – CreditMantri

Talk about wasted money. Furthermore, overspending on credit cards could drive down your credit score. One big factor that plays a role in determining your credit score is your credit